- #Rental property tracker plus review registration#

- #Rental property tracker plus review software#

- #Rental property tracker plus review mac#

You must also report income that you have received constructively.If you receive goods or services from your tenant in exchange for rent, you must report the value of the goods or services as rental income on your return for the year in which you receive them.If you receive a deposit for first and last month's rent, it's taxed as rental income in the year it's received.If you receive rent for January 2022 in December 2021, for example, report the rent as income on your 2021 tax return.In general, you must report all income on the return for the year you actually receive it, even though it may be credited to your tenant for a different year. Schedule E is then filed with your Form 1040.You report rental income and expenses on Schedule E, Supplemental Income and Loss.You're allowed to reduce your rental income by subtracting expenses that you incur to get your property ready to rent, and then to maintain it as a rental. Yes, rental income is taxable, but that doesn't mean everything you collect from your tenants is taxable. What are passive activities, and how do they affect me?.How do I report a rental activity on my tax return?.

If I rent out my vacation home, can I still use it myself?.What if I pocket some of the security deposit?.Taxpayers in similar circumstances find themselves asking these questions: But as first-time landlords, they don't know whether they need to report the rent they receive on their tax return and, if so, whether any of the money they spent to get the condo ready to rent is deductible.ĭoes this story sound familiar? If so, you're not alone. Because the rental market in their area is improving, they decide that instead of selling Sue's condo, they could make some money by holding on to it and renting it out. Universal Calculator: computes numbers, dates, times, measurements and currency conversions.When you rent out a house or condo, taxes can be a headache.Īfter buying a condo and living in it for several years, Sue meets Steve, marries him and moves into his house.Work Order Tracker: keeps track of any repairs or maintenance schedules.Asset Tracker: keeps track of any appliances, furniture, etc.Task Tracker: a handy To Do list generator.Schedule Tracker: apppointment tool creates printable schedules.Contact Tracker: send form letters to any or all contacts, tenants or owners.Other Income Tracker: deposits and income from a variety of sources track all of your income and expenses create account registers for any number of accounts.Expense Tracker: track tax deductible expenses, print checks, and create tax form reports prepare property manager accounting reports for printing or exporting to a spreadsheet quickly and accurately.Tenant Tracker: complete tenant info, payment history, tenant notices, rent roll and other reports.

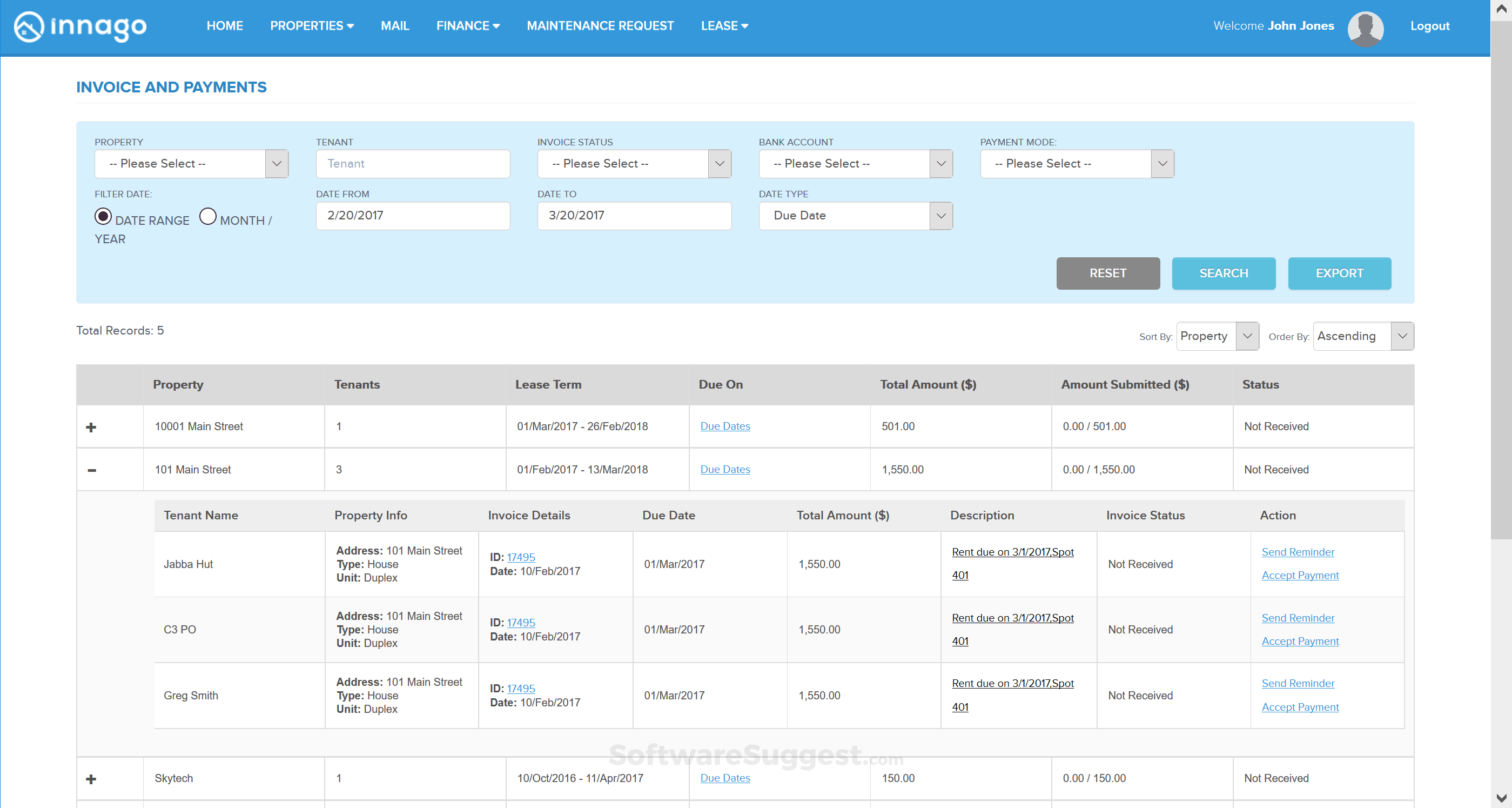

Unit Tracker: rental history, owner info, etc.Rental Income Tracker: create statements and receipts for charges, deposits and payments monthly, weekly, fortnightly and multi-monthly rental periods are supported accept government housing subsidies (Section 8 housing payments and vouchers) as partial rent payments accept online credit card payments.Rental Property Tracker Plus Key Features

#Rental property tracker plus review software#

They also provide inventory tracking software for SOHO or micro businesses, which manages sales and rental income, expenses, schedules, and more. The company offers desktop accounting applications for short-term vacation rentals, long-term tenant landlords, campgrounds, bed and breakfasts, and commercial leasing managers.

#Rental property tracker plus review mac#

Since 1999, SpiritWorks Software Inc., based in Oregon, has been creating award-winning personal productivity software for self-employed professionals, very small businesses and property rental managers, for use on Mac and Windows computers. This easy-to-use rental property manager software helps you keep track of your income, expenses, rental units, and tenants. Rental Property Tracker Plus is complete residential property management software for keeping track of your rental income and expenses and who still owes you money.

#Rental property tracker plus review registration#

Users get a free 10 day trial, then purchase a registration number for $199, which unlocks the software for unlimited use and includes updates and technical support. Founded as a sole proprietorship and then incorporated in 2008.

0 kommentar(er)

0 kommentar(er)